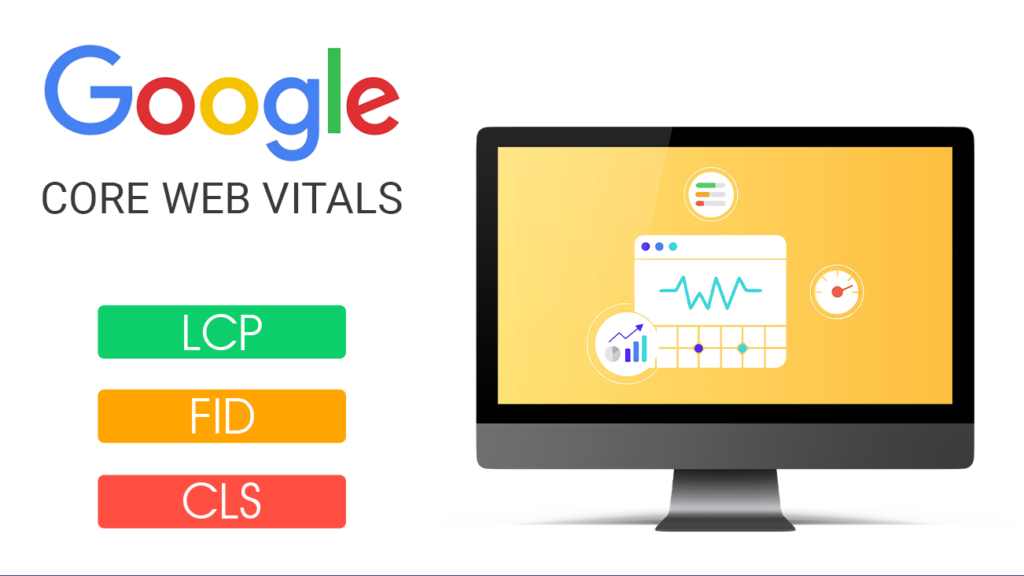

WordPress vs Drupal: Core Web Vitals

Introduction Ancient Greece had its Trojan War, the Romans waged their Punic Wars, and WordPress and Drupal are locked in an unending development war. And as you might expect, both sides proclaim themselves to be the best. To know if your WordPress or Drupal site is up to the challenge of handling traffic, performance issues, […]

A Complete Guide on Digital Wallet

Introduction A digital wallet (an e-wallet) is an electronic system that allows parties to trade digital money for goods. This includes making online transactions using tablets, computers, and cellphones. Before any transactions can occur, money is held in a digital wallet. In other circumstances, an individual’s account may have an electronic link to that digital […]

What is Fintech: A Complete Guide On Financial Technology

Introduction The word Fintech has become a buzzword today, with a variety of different meanings. From digital lending to asset management to innovation in insurance, there have been a number of significant financial changes that can be attributed to technology – all within the last decade. But what, exactly, is Fintech? Fintech is the idea […]

Top 10 Mistakes To Avoid In Your E-Commerce Website Design

Introduction An E-commerce website’s design is not only essential for attracting click-throughs and E-commerce leads, but it’s also one of the most important factors for keeping customers engaged and returning. Anything from functionality issues to improper wording or images can deter or drive off a potential customer. As a business owner, you want to make […]

Headless Commerce: Introduction, Risks & their Solutions for Enterprises

eCommerce is the fastest growing industry of the 21st century. An eCommerce website is divided into two parts: front-end and back-end. The front-end is what users see while the back-end deals with the business side of things. Be it Amazon Dash buttons, voice assistants, or providing new ways to explore information on a website, consumers […]

Warehouse Management: Tips for Efficient Ecommerce Order Fulfillment

There’s nothing more frustrating for a customer to find out that their selected product or the item trending on Instagram is out of stock – not a big deal. But the worst-case scenario occurs when they’ve already paid for the product, and then they receive a message that the product is not available in the […]

Benefits of using Shopify: Why use Shopify CMS for eCommerce development?

Are you a budding Entrepreneur or a medium-size business owner who wants to sell stuff online? Do you wish to open your online store but don’t have the right skills or understanding of website design? If your answer is yes to any of the above questions then Shopify CMS is the right solution for you. […]