A Complete Guide on Digital Wallet

Introduction

A digital wallet (an e-wallet) is an electronic system that allows parties to trade digital money for goods. This includes making online transactions using tablets, computers, and cellphones. Before any transactions can occur, money is held in a digital wallet.

In other circumstances, an individual’s account may have an electronic link to that digital wallet. In some instances, users have their driving license or other identification documents in their wallets.

This article will go over everything there is to know about digital wallets. The aspects that will be explained later in this article are as follows:

What exactly is a Digital Wallet?

How do Digital Wallets work?

Types of Digital Wallets

- Semi-closed Wallets

- Open Wallets

- Closed Wallets

Choosing the Most Appropriate Digital Wallet

- Desktop Wallet

- Mobile wallet

- Bitcoin wallet

The Best Digital Wallet options

- Venmo

- Samsung Pay

- Google Wallet

- Android Pay

- AliPay

- Cash App

- PayPal

Crypto wallets

Digital Wallet vs Crypto Wallet

Digital wallets—the benefits

Conclusion

What Exactly Is A Digital Wallet?

Digital wallets live up to their name by providing a digital representation of your bank accounts. You can access it from a computer, smartphone, or smart device. It eliminates the need to carry around a physical wallet.

A digital wallet includes both software and data. Secure and fair electronic payment systems are a crucial concern. It safeguards personal information and the actual transaction by encrypting it.

Digital wallets are entirely compatible with the majority of e-commerce systems; stored and maintained on the client-end.

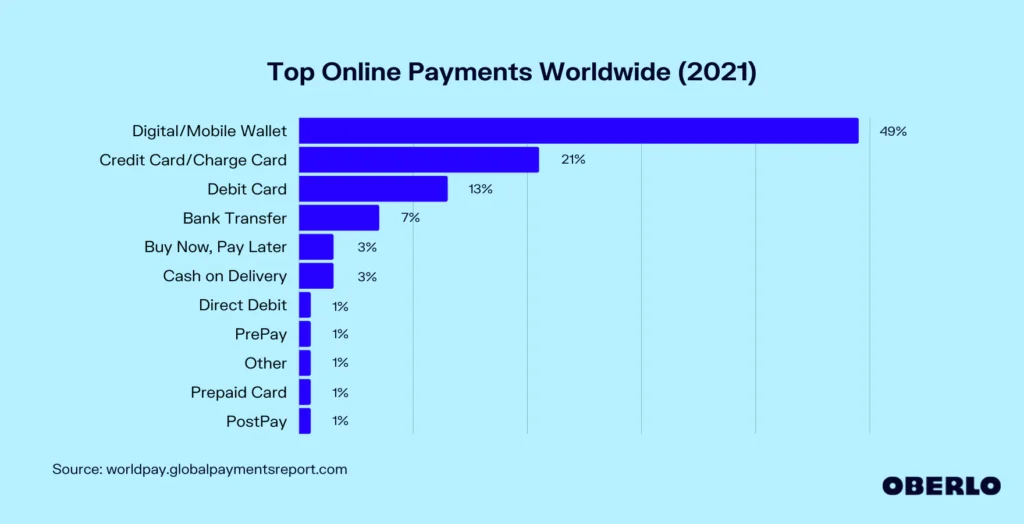

How Popular is Digital Wallet as an Online Payment Method?

As per the Global Payments Report for Financial Institutions and Merchants 2022, 49 percent of total ecommerce expenditure worldwide was paid using digital / mobile wallets.

Image source: Oberlo

How Do Digital Wallets Work?

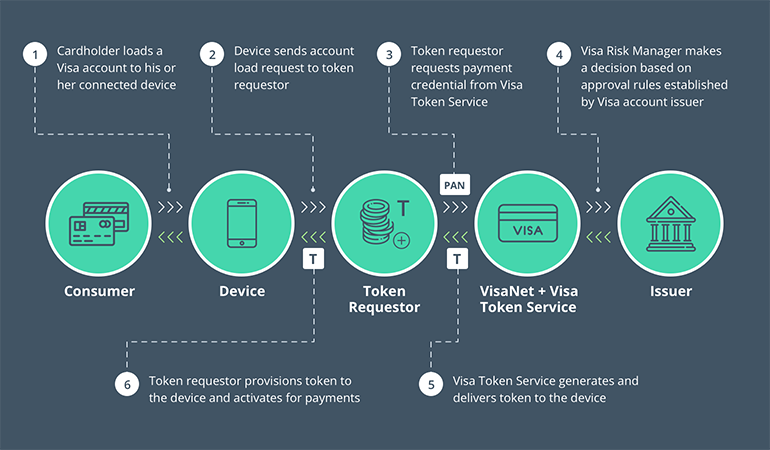

Image source: intellias

A digital wallet employs software to connect your payment data from your linked bank account to the seller with whom you are transacting.

First of all, determine which one you want to use, which is affected by the mobile operating system.

If you wish to use a digital wallet, you must first enter your credit card details into your chosen app or website. Your data will be encoded, and you will only be able to access the wallet after unlocking your smartphone and allowing its use.

You have to approve your digital wallet and hold it close enough to the card reader to communicate your data to make a mobile payment. Some shopkeepers do not accept mobile payments. Look for the contactless payment sign on the retailer’s point-of-sale system or card reader.

Types of Digital Wallets

We have three distinct types of digital wallets based on the criterion for making transactions. These types are discussed below:

Image source: patriotfcu

Semi-closed Wallets

Semi-closed wallets are used by users who want to make transactions with a specific set of businesses. Although the wallets’ coverage region is limited, you may use them for online and physical purchases. On the other hand, Sellers must engage in agreements or contracts with issuers to accept payments using mobile wallets.

Open Wallets

Banks and their partners issue open wallets. Users who have open wallets can use them for transactions that a semi-closed wallet allows. It includes withdrawals from banks, ATMs, and financial transfers.

Closed Wallets

Companies create closed wallets for their consumers. You can only use them to send payments between the user and the wallet issuer. The funds in a closed wallet can only be used to perform transactions with the wallet’s issuer.

Money from cancellations, returns, and refunds are kept in wallets like Amazon Pay.

Choosing The Most Appropriate Digital Wallet

It’s not difficult to choose a suitable digital wallet for yourself. All you have to do now is ask yourself some questions. Which digital wallet app is the greatest, and which one is the best for cryptocurrency? Before you answer these questions and investigate the many options available, have a look at the following categories:

Desktop Wallet

Desktop wallets are software apps that are installed on the desktop or laptop of a computer and provide the user complete control over the wallet. They also make sure that all security measures, such as virus protection, are in place and that the data in question is backed up. Desktop wallets with extra functionality, such as node software or exchange integration, are available.

Mobile Wallet

A mobile wallet is accessed using a smartphone application. Mobile wallets are a convenient solution for users to make in-store purchases. You may use them at any retailer that the mobile wallet service provider has listed.

Like desktop wallets, the user handles backing up the device in question to keep all the data safe.

Bitcoin Wallet

A Bitcoin wallet allows you to transmit and acquire bitcoins. It does not keep real money. This wallet saves the cryptographic data needed to access Bitcoin addresses and perform transactions.

Some Bitcoin wallets also allow you to store other coins besides bitcoin. Bitcoin wallet seems to be a genuine wallet.

The Best Digital Wallet Options

Here we have some best digital wallet options for you:

Venmo

Venmo is a digital wallet that helps everyone manage their money, from students to small companies. Venmo is a financial platform that allows you to pay and request money from pals.

While it’s still the easiest and most popular way to split cab fare, it’s evolved into a financial platform that may be all you need in addition to a standard bank account.

Samsung Pay

Samsung Pay makes it easy to pay securely. Because of NFC and MST support, it’s accepted in more places than most other mobile payment methods.

All you have to do is swipe up from the home button and approve the payment using your phone’s highly secure fingerprint recognition system. Then, in a couple of seconds, place the phone against the card reader, and you’re done.

Google Wallet

Google Wallet is another famous digital wallet. It allows users to make transactions directly from their phones. It has made payment transfers far too simple. Users may save credit, gift, debit, and loyalty card information for free.

Google Wallet is a new method to pay at e-commerce companies that accept it, and it’s available to anybody with a more recent Android or Apple smartphone.

Android Pay

Android Pay is a Google-developed mobile payment platform that allows users to make in-app, online, and tap-to-pay transactions with their smartphones.

Android Pay saves and manages digital copies of your cards, from loyalty cards to credit cards. All of your incentives are instantly applied when you purchase at a certain merchant.

Visa and MasterCard are among the expanding list of banks and cards that Android Pay supports, and this number will rise significantly as the service expands into more countries.

AliPay

AliPay is another famous type of digital wallet. Users of AliPay keep their debit or credit card information in the app, allowing them to make payments using their phones.

AliPay has partnerships with various financial institutions, most notably Chinese credit, debit, Visa, and MasterCard.

Cash App

Cash App is a money transfer business that focuses on mobile apps. You may make online transactions directly and rapidly. Cash App has a few extra features as compared to other digital wallets.

It provides you with the facility of a bank account and a debit card. You can use that card at any ATM. The program also allows you to invest in both bitcoin and stocks.

PayPal

PayPal’s service allows you to make online transactions over different e-commerce stores. You can send money to friends and family in a quick and easy way without having to divulge financial information.

PayPal is a global money transfer behemoth with over 400 million active accounts worldwide. Many online businesses and customers are familiar with and trust the service since it is so widely used.

Crypto Wallets

Crypto wallets keep the private keys that grant you access to your cryptocurrencies. It ensures safe and secure access while allowing you to transmit and receive cryptocurrencies.

Digital crypto wallets are handy since they allow you to manage all of your currencies in one location, transfer and receive money, and even purchase at crypto-accepting shops.

They exist in both form: hardware wallets and smartphone applications that make using crypto as simple as purchasing online with a credit card.

Digital Wallet vs Crypto Wallet

Both digital wallets and crypto wallets are viewed as digital money at face value, and it’s simple to confuse the two as the same payment mechanism. However, there is one significant distinction between the two.

Actual money or valuables are maintained within digital wallets. This isn’t usually the case with a crypto wallet, which stores the keys that permit cryptocurrency transactions within each coin’s digital ledger.

Crypto wallets are not like digital wallets, which are essentially electronic replicas of what you’d carry around in a physical wallet. They are used for buying and selling cryptocurrency. Put another way, the basic purpose of a digital wallet is to pay for items. To buy cryptocurrency, most people use a crypto wallet.

Yet, there are certain similarities between mobile and crypto wallets. You might use a crypto wallet to pay for products or services at establishments that take cryptocurrency, just like you could with a mobile wallet. Both wallets are significantly safer than carrying a credit card around with you.

Digital Wallets – The Benefits

There are several reasons and advantages to adopting a digital wallet, which may eventually replace a physical wallet. Here are five compelling reasons to get started.

- Rewards for your purchases

- For faster checkout, use contactless payment.

- Convenience

- It allows you to be more organized.

- Improve Security

Conclusion

Digital wallets provide a more adaptable and secure alternative to conducting in-person and online transactions. It’s simple to link your credit and debit cards to your mobile wallet and begin paying without using cards or paper money.

Mpire Solutions provides FREE Consultation by analyzing your digital commerce metrics and advising you on the ideal digital wallet.