What is Fintech: A Complete Guide On Financial Technology

Introduction

The word Fintech has become a buzzword today, with a variety of different meanings. From digital lending to asset management to innovation in insurance, there have been a number of significant financial changes that can be attributed to technology – all within the last decade. But what, exactly, is Fintech?

Fintech is the idea that technology is changing the way we do financial management, from the little-known wallet on our phones to the largest stock exchange in the world. The term encompasses everything from investing in cryptocurrency to simplifying banking between countries. With Fintech, venture capitalists and investors can trade more efficiently, collect more data on customers, and make slight changes that can have great effect over time.

This blog post covers the following topics:

- Introduction

- Examples

- How Does Fintech Work

- Financial Technology in Practice

- Types of Fintech Companies

- Fintech History Timeline

- The Fintech Evolution Cycle

- The Fintech Expansion

- Latest Trends in the Fintech Industry

- Typical Fintech Users

- Applications of Fintech

- Conclusion

Introduction

Financial Technology (Fintech), sometimes called “financial innovation,” is a catch-all term for any sort of technology that impacts the finance industry, such as mobile banking.

It is the portmanteau of “financial” and “technology”—a sector that deals with how financial services are provided by utilizing technology.

Put another way, it’s tech that helps you manage your money.

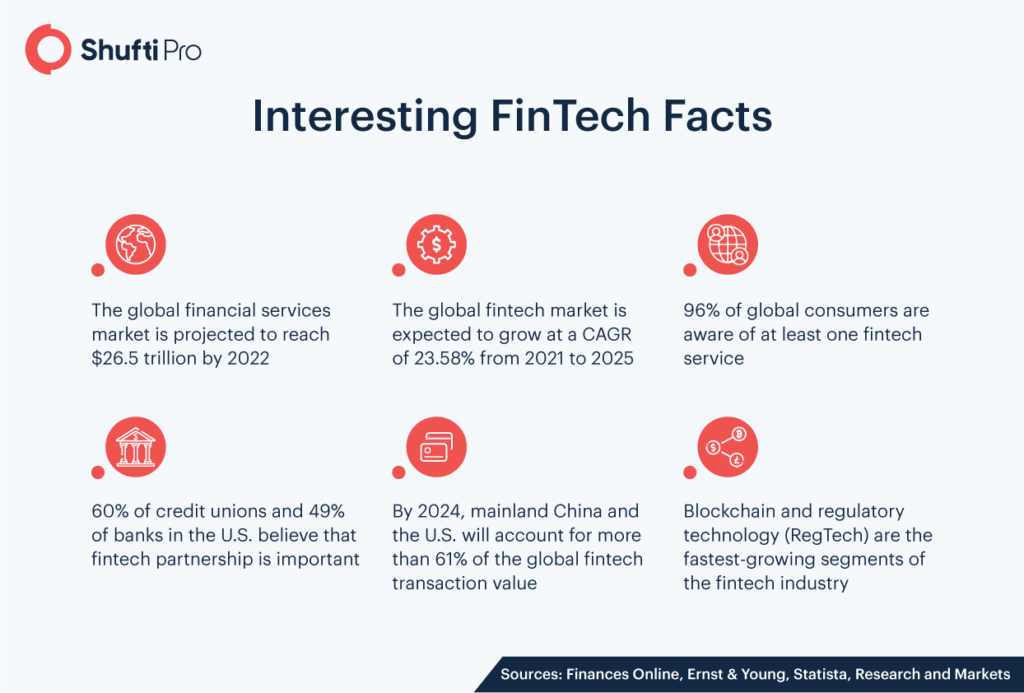

Source: ShuftiPro

Examples

Some examples of fintech companies include:

Credit Karma—provides free credit scores, credit reports, and recommendations for products like credit cards or loans that the user might be interested in

PayPal—an online payment system that allows customers to transfer money without sharing financial information

Kabbage—a company that uses software to predict cash flow and automate lending decisions to small businesses

Moven— mobile-only bank account where you can manage your money online via an app

Acorns—it rounds up your purchases to the nearest dollar and invests that spare change for you automatically

How Does Fintech Work?

The term “financial technology” can mean different things to different people, but it typically refers to the use of information technology in financial services.

In practice, this means that computers and software are used to help financial institutions and businesses streamline their processes and offer innovative products and services.

As an example, a fintech company might create software that helps banks offer loans more quickly and easily than they would be able to without this software.

Fintech companies are typically startups that aim to disrupt established institutions by introducing new technologies into the financial sector. This means they can often be more nimble and responsive than traditional banks or other financial institutions, which have been around for years or even centuries.

Financial Technology In Practice

Fintech has been around for a while; it’s not new. But the way it’s being used is changing rapidly. The banking sector, for example, has experienced something of a revolution in how they provide services to their customers. Whereas you once had to go into a bank to do your banking, now you can deposit checks with your phone and transfer money from your checking account to your savings account with just a few taps on an app.

In the past, in order to send money to a friend, you had to write them a check or meet up in person to hand over cash. With apps like Venmo and Zelle, sending money can be done in a few taps on your smartphone—and it’s all free!

There are also options for making purchases with your phone instead of credit cards and cash. Apple Pay, Google Pay, and Venmo Credit Card let you tap your phone at checkout instead of pulling out your wallet.

Want to buy some stock? You don’t have to call a broker anymore (assuming you don’t want one). You can just sign up for an online investing platform like SoFi, which will allow you to invest in the stock market and even trade options without any human interaction at all. Is that more convenient and less expensive? Yes, it is.

Types of Fintech Companies

Fintech is an industry made up of companies that use technology to make financial services more efficient. There are two types of fintech companies: those that serve consumers directly and those that serve businesses and government organizations. Some examples include:

a). Consumer-facing: companies that help customers manage personal finances, invest, or borrow money. Examples include Stripe, Credit Karma, and PayPal.

b). Business-facing: Companies that work with banks, governments, and other financial institutions by selling software products or offering services. These products can range from fraud detection to financial management tools for small businesses. Examples include Kabbage and Gusto.

Fintech History Timeline

This is a brief history of how Fintech has evolved, from the 1970s to today.

1970s: First ATMs and Credit Card Machines

The 1970s was the beginning of Fintech. This was when the first automatic teller machine (ATM) was introduced, allowing people to do basic banking tasks without going into a bank branch, as well as the first credit card machine, which allowed people to pay merchants electronically.

1980s: Computers and Online Banking

The 1980s saw a revolution in digital capabilities, with the invention of affordable personal computers that could be used by ordinary people. This led to online banking becoming more common.

1990s: Internet and Fintech Companies

The 1990s saw a huge increase in Internet usage, allowing people to communicate in new ways with each other and with businesses. This led to new companies like PayPal being founded, which were dedicated to using technology for financial transactions.

2000s: Mobile Fintech Apps and New Technology

The 2000s saw a boom in mobile internet access and mobile app usage, leading to a boom in mobile fintech apps designed for smartphones and tablets.

Ever since then, fintech has only grown exponentially. There are now thousands of companies working on solutions for everything from stock trading to personal finance tracking, and we’re still just scratching the surface of what’s possible!

A History of Fintech from Morse code transactions to Monzo

Source: Raconteur

The Fintech Evolution Cycle

Fintech—or financial technology—has made way for an entirely new, more convenient approach to banking and making payments. It’s created a world with fewer hidden fees, paper checks, and hours spent waiting in line at the bank. But how did we get here?

Fintech has come a long way since the 1970s. Back then, it was mostly used by banks and other financial institutions to automate back-end processes. In many ways, though, its evolution is tied closely to that of the smartphone: as it became more powerful, it also became more portable.

That meant that apps could be developed to make banking more streamlined and less time-consuming. Those apps paved the way for digital wallets and online-only banks—and now we can’t imagine life without them. As fintech continues to evolve, it’s sure to bring even more changes that will shape the future of finance in incredible ways.

User’s Desire for Convenience

Fintech “evolved” out of users’ desire for convenience in their financial transactions. As technology made it easier and easier to do other things online (e.g., buy movie tickets), people began asking why they couldn’t do things like paying their bills online as well. This led to the rise of online banking and then mobile banking.

Once financial institutions started allowing consumers to access certain services online, they started looking for ways to make these services even more convenient. This was when instant payments became popular; instead of waiting a day or two for your payment to clear, you could receive your money immediately and can send money instantly.

Consumer’s Desire for Security

The recent rise of Fintech is due to a fundamental change in consumers’ attitudes toward their financial transactions. The financial industry has always been extremely sensitive because the companies in it essentially hold the keys to the kingdom—our money. Consumers are now looking for security and trust when considering which companies to conduct their business with.

Fintech has uniquely positioned itself to fill that need. Companies in the sector pride themselves on providing financial services that offer customers reliability, safety, and stability. They have also increased their technological sophistication through innovations like mobile payments and digital bank accounts, allowing customers access to their funds 24/7.

The Desire to Control Transactional Aspects

The rise of fintech was a natural outgrowth of buyers’ and sellers’ desire to control more aspects of transactions themselves. In the beginning, this was limited to the ability to buy goods from anywhere in the world and have them shipped quickly. Later, it expanded to include things like keeping money in an online account instead of a brick-and-mortar bank and then sending payments electronically instead of by check.

Most recently, fintech has manifested itself in the form of AI systems that can anticipate when people will need financing and then provide it to them automatically through a system like PayPal or Venmo. This is just one example; there are many others!

Peoples’ Desire for Time-Saving Solutions

Fintech has evolved out of people’s desire for time-saving solutions. It has the ability to reduce the amount of time people need to spend on all aspects of their financial lives, from managing money to making payments.

People can complete financial activities and transactions in a fraction of the time that it used to take them before the fintech revolution. They can do things like:

- Make payments at the tap of a button on their mobile phone

- Check their bank balance or view their recent transactions with a few simple clicks on their smartphone app

- Transfer funds between accounts instantly through online banking or automated services

So-called “fintech” (financial technology) companies are now offering products that allow customers to handle their own finances from their phones or computers—no bank teller required.

What exactly does fintech mean for the average consumer?

Well, for one thing, it means you can do your taxes without sitting down with a tax professional or pulling out a calculator. F

or another thing, it means that you can take out loans without applying at a brick-and-mortar bank—and thousands of startups are now providing online lending services.

Now more than ever, consumers can manage their money on their own terms and make informed decisions with just a few clicks of their mouse or taps on their phone screen.

The Fintech Expansion

Fintech has many faces.

Mobile-only stock trading app Robinhood has swelled to 22+ million users since its 2014 launch and raised $3.4 billion in venture capital in 2021-2022, alone. Peer-to-peer lending sites like Lending Club and Prosper are now publicly traded companies with a combined $6 billion in revenue.

Business loan providers including OnDeck and Kabbage have each raised more than $100 million in investment. Insurance startups like Oscar and Lemonade promise to disrupt the industry for millennials, while banking cafes by Capital One and Capital One 360 help customers manage their money over coffee.

Source: Consultancy EU

In fact, some fintech companies aren’t even focused on turning a profit. They’re more concerned with providing services to those who would otherwise be unable to get those services any other way. For instance, Bancosol was started in Peru to offer banking services to people who previously had no access to a bank.

Latest Trends In The Fintech Industry

Fintech is a fast-changing industry, and there are plenty of exciting new things happening in it. Here’s a rundown of the latest trends.

Typical Fintech Users

In the financial technology (fintech) industry, there are two main kinds of users: consumers, who use fintech to manage their own finances, and businesses that use fintech to manage their finances as well as the finances of customers.

Business-to-Consumer (B2C) Fintech Users

Consumers often use fintech to do things like sending money across country lines at a low cost, making payments using mobile devices, or investing in the stock market.

Business-to-Business (B2B) Fintech Users

These companies use fintech to facilitate financial transactions with their customers or other businesses. For example, a company might use fintech to take credit card payments from its customers.

Business-to-Friend (B2F) Fintech Users

But there is another group out there that is sometimes overlooked, and that is people who use FinTech casually. We call this group B2F (Business-to-Friend).

For this type of user, Fintech is all about simplifying life, not complications. It’s about taking care of simple tasks like splitting bills, requesting loans from friends, or sending money to friends. And it’s about providing a service that simply makes life easier.

Applications Of Fintech

Fintech, or financial technology, has made big waves in the financial services industry in recent years. With the advent of new technologies, traditional financial institutions and companies are being challenged to keep up with the demands of customers and clients. Here’s what you need to know about the applications of fintech.

Mobile Banking & Neo Banks

Mobile banking is one of the most popular applications of fintech. More and more people are doing their banking online or via mobile apps. One example is Cash App (previously Square Cash) a mobile payment service that allows you to send money to your friends immediately via their app.

Another application of fintech is neobanks. Neobanks are small banks that have no brick-and-mortar locations—they only operate online. They typically offer better interest rates on savings accounts than traditional banks do. One example is Varo Money, a neobank that also offers no-fee checking accounts and loans.

Cryptocurrency & Blockchain

Cryptocurrency and blockchain are different things, but they’re also very much inextricably linked in the Fintech sector.

Cryptocurrency is a digital currency that has no physical form and exists only in digital. Blockchain is an electronic ledger that allows users to record each transaction made through cryptocurrency.

Because there’s no physical version of the money and transactions happen digitally (i.e., there’s no exchange of paper money or coins), it’s easy to see why the cryptocurrency is so appealing to users. However, the absence of physical money also opens up opportunities for fraudulent activity, which is where blockchain comes in.

Blockchain allows users to keep track of every single transaction made with cryptocurrency. It works like a Google Docs spreadsheet, where only people who have been granted access can make changes to what’s written on the document. In this case, the “document” is a public ledger of all transactions made with the currency.

Each new transaction is recorded as a new line on the spreadsheet—so if you’ve ever been on a group project where you all worked on an online spreadsheet together, you can get how this works!

Investment & Saving

Fintech has caused an explosion in the number of investing and savings apps, like Acorns and Betterment. These apps make it easier for millennials to invest by allowing small, regular contributions from checking accounts or debit cards and managing investments for them using sophisticated algorithms. In some cases, they can even round up purchases to the nearest dollar and contribute the difference to a savings account.

While Fintech has been around since the early 2000s, the growth of consumer-oriented Fintech businesses has been exponential in recent years. Many people are giving up on traditional banking because of its high fees, long wait times, and lack of personalization. Millennials especially are looking for easy ways to do their banking—including managing their investments—from their phones, which is something that traditional banks have struggled with.

And we’re just getting started—Fintech is growing at nearly three times the rate of other financial services sectors!

AI Machine Learning & Trading

Machine learning has had a huge impact on finance over the last decade. With machine learning, computers can analyze millions of data points from many different sources, and use them to build predictive models that reveal trends in financial markets.

These models can be used for all kinds of investment strategies, from swing trading to long-term value investing. The ability to process so much data so quickly is an incredible advantage for traders, who can now look at trends across many different time frames in order to make more effective trades.

The example we’ll use here is algorithmic trading: a strategy where a computer program makes decisions about when to buy and sell financial assets based on the patterns it discovers in historical data. Algorithmic trading uses machine learning techniques like logistic regression or support vector machines to estimate when stocks will go up or down in value, as well as how much they’ll change by.

Here’s another example:

Let’s say you want to invest in a company that produces state-of-the-art hoverboards—but you’re just not sure how much you should invest, or if it’s a viable investment at all. Machine learning algorithms can search through hundreds of thousands of data points to find every company involved in hoverboard manufacturing—even if you didn’t know those companies existed!

Insurance

One of the most exciting benefits of the fintech revolution is how it has affected the insurance industry. Insurance companies can now use technology to better understand the risk of their policies, cut down on fraud, and provide more customer-centric services.

For example, instead of solely relying on an annual checkup to assess a person’s health, life insurance companies are now beginning to use wearable devices for constant monitoring and proactive care. Progressive Auto Insurance also offers its customers a device that tracks how many miles they drive and then gives them a discount based on their actual usage. They’ve even started offering discounts to people who bundle home and auto insurance policies!

Conclusion

With all these buzzwords, it’s hard to grasp the various subjects and technologies that fall under the fintech umbrella. Fintech is a new and exciting field that has made financial processes more engaging and freed them from their traditional organizational structure. The essence of fintech is disruption through technological innovation, and there are many ways in which it impacts our world.

It is a wide, wide field and it is in constant motion. To get a sense of things, start by thinking about all the financial services that exist today – everything from peer-to-peer lending to crowdfunding, from insurance to investing advice, from mobile banking to blockchain technologies, are falling within its ambit. Fintech is all about empowering the citizen user and creating more efficiency.

And if you are looking to build a fintech solution in the form of a website, mobile app or a software, Mpire Solutions has a highly skilled development team that can help you. Connect with us for a FREE Consultation.