How to apply for the SBA disaster loan application online?

Small businesses in the U.S that have been affected by coronavirus can apply online for low-interest loans through Small Business Administration (SBA).

The money is available for startups and nonprofits which is meant to replace the short-term loss in revenue. There is no cap on how many loans can be distributed to businesses. Each qualifying business can get a loan up to $2 Million.

No one was prepared for this disaster, but everyone needs the right assistance quickly.

If you are a small business owner, then SBA can help you fish out of water.

What is the SBA Injury Disaster Loan?

Those businesses that are affected by coronavirus can apply for SBA Injury disaster loan online. This low-interest loan can help startups with fixed debts, accounts payable, and every other foreseen expenses that occurred in the coronavirus outbreak.

If your business was doing great even before the outbreak, a loan could help you with future financial problems.

SBA gives loans up to $2 M (depends upon your application) that’s support for small startups who fail to get credit from elsewhere.

Loans can be used to cover expenses that would otherwise go unpaid because of the economic effects of the coronavirus.

Who Qualifies for an SBA economic disaster loan?

The loan is available for small businesses, private nonprofit organizations, and small agriculture co-ops. The SBA defines a small business as a business with 500 or fewer employees. This doesn’t mean that Wall Street banks or GM are not fit for the loan; it’s just giving out money to small businesses first.

For your business to qualify, you must have an economic injury from the COVID-19 crisis and live in a state where the loan is offered.

When is the right time to apply for the loan?

The coronavirus crisis is more dangerous than the Great Recession in 2008-9. The virus hit so quickly that no one had the time to respond or prepare for it.

If you are in financial strain caused by COVID-19, now is the time to apply for the loan. The funding is finite. So, it’s better if you apply fast.

As a business owner, to keep a backup option is smart. Because there is no guarantee when the loan will be processed and how long will it take for funds to allocate. Apply for the loan even if our business is not severely affected.

Do these before you apply for the loan

- Prepare a detailed personal financial plan. Submit your taxes for 2019.

- Gather three years of personal and business tax returns. If taxes of 2019 are not available, then create a financial plan before those years and end in 2019.

- You must show monthly operating expenses from March till September 2019. The data is necessary for your loan application.

- Forecast and prepare the budget of 2020 – the best-case scenario, expected, and the worst-case-scenario. It will give a good impression to the lenders.

- Prepare a debt schedule.

How to apply for an SBA Disaster loan online?

Apply for a loan with this link.

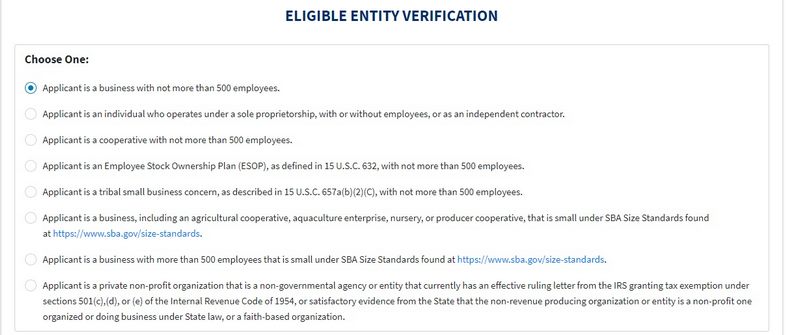

Scroll down and select, “Applicant is a business with not more than 500 employees.”

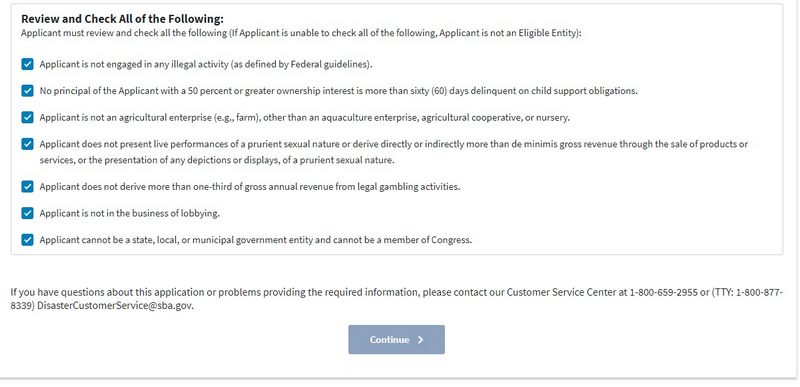

From the ‘Review and Check all of the following’ tick every option and select Continue.

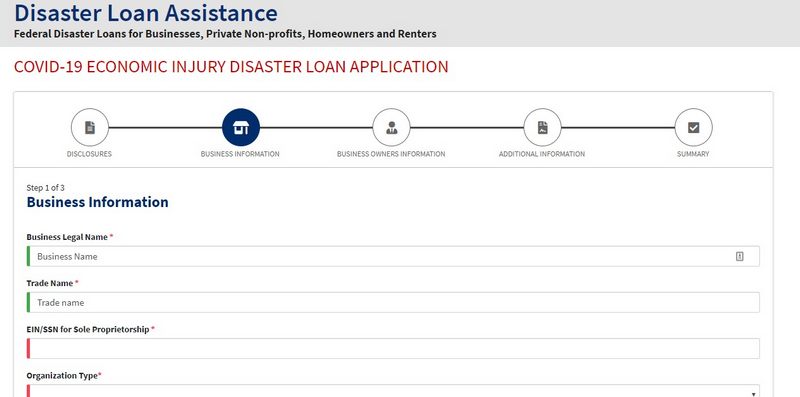

In the next section, fill out your Business information.

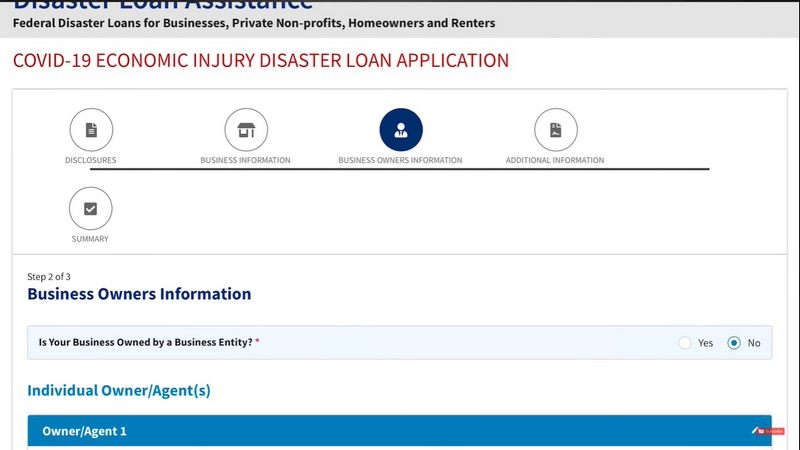

The next step is to fill the business owner’s information.

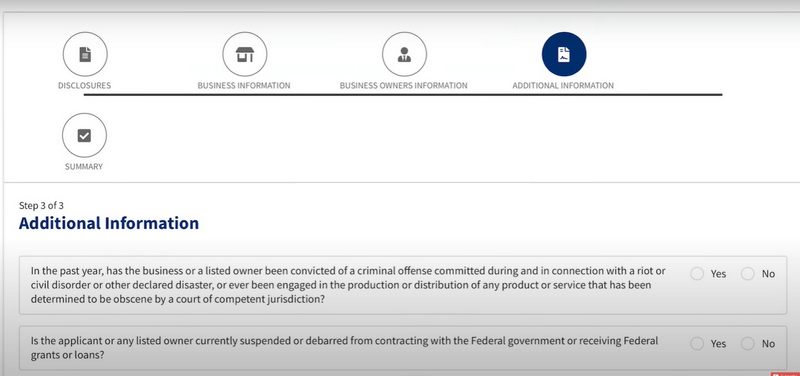

The final step is the Additional information.

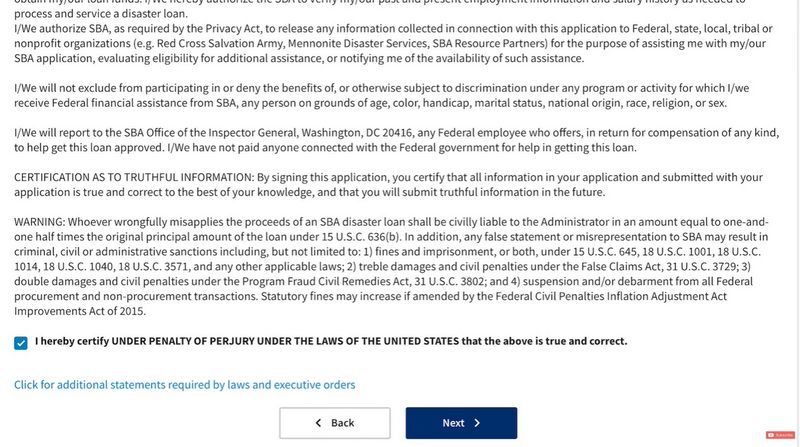

Certify with a tick and click Next.

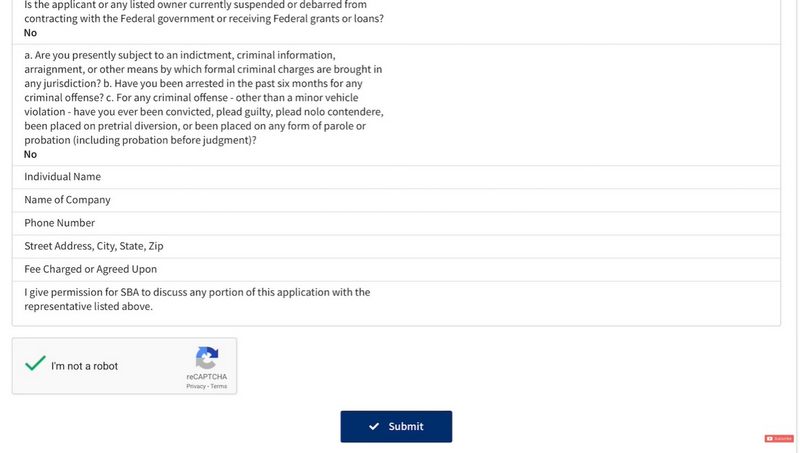

In the last step, you’ll get a summary of everything. Check everything carefully and click Submit.

You’ve applied for the loan, now what?

- Once the application is submitted, you’ll get an application number. Just print and save this number.

- When an SBA representative calls you, they will refer you with the application number.

- You’ll receive email updates from SBA with an email account that ends with sba.gov.

- SBA warns businesses with fake/phishing attacks that might attempt with an SBA logo. It’s an attempt to obtain your personal information or install ransomware on your computer. Avoid them at all costs.

In the end, if you are considering an emergency loan. It will offer you low-rates and more extended payback time. It’s a slow and complicated process.

Ideally, the SBA loan will get you to the finish line faster. It’s perfect for those startups and businesses who think that they cannot survive the COVID-19 crash, and things don’t look good in the future.